Balance Sheet of a company in Excel: This is how it is done

In the business world it will always be vital to know the state of the business in different dimensions and for this, there are various reports and documents. In that sense, today we want to talk about the balance sheet and how to use Excel to facilitate its construction.

Considering that this is one of the most basic and important financial status reports, we are going to review everything we need to create one.

If you have a business and have not yet generated your first balance sheet: Don't worry! Here we will tell you everything you need to know about it.

What is a Balance Sheet in Excel?

Companies are made up of a series of tangible and intangible elements, which ultimately represent money. However, these elements have different natures. Therefore, it is necessary to organize them to clearly see the financial and economic panorama of the business.

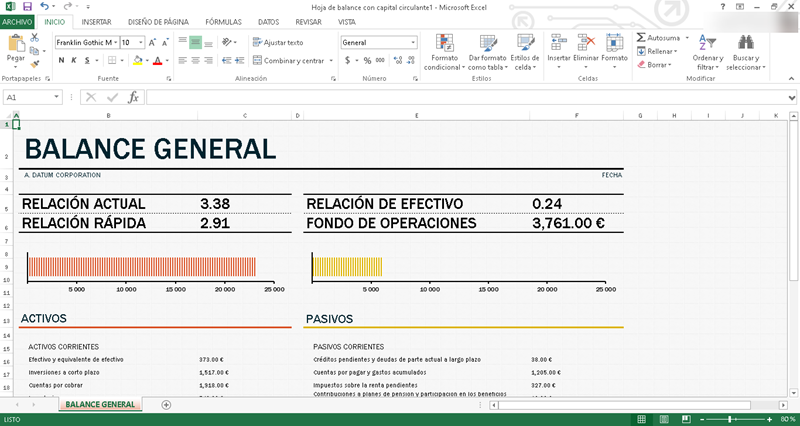

In this way, we can define the balance sheet as a document or report that concentrates the information of a company, divided into 3 sections: assets, liabilities and net worth.

This is an elementary report for any company. This must be updated at least annually. The good news is that, with the right information, We can easily generate the general or initial balance sheet of a company in Excel.

What data should a company's Balance Sheet contain in Excel?

The balance sheet is a report with a specific structure that must be respected and maintained, in order to have a correct document, both in format and information. In that sense, we are going to review the data you need to build an Excel balance sheet spreadsheet.

Company assets

We can define the company's assets as all the assets it has and with which it could generate money through exchange transactions, sales or using them. Within the assets we can include everything from a computer to the financial investments that have been made.

To obtain the assets of the company, you must add the liabilities and the net worth.

The liabilities of the company

If we want to put it simply, liabilities are what the company owes. To see it more clearly, it refers to all the debts that the business incurs to finance its activity. In that sense, we can include in this account everything from the bank loans requested to the amounts we owe to those who provide services to the business.

To calculate the company's liabilities, the Assets and Net Worth must be subtracted.

The equity or accounting capital of the company

When we talk about assets, we refer to all the company's own assets that are not subject to debts with third parties. In that sense, the funds contributed by owners or shareholders and also the benefits or profits produced and not distributed among the partners are part of this section.

However, within an Excel balance sheet spreadsheet we will talk about Net Worth because it refers to all assets without debt. In this way, to obtain the value of Net Worth, you will have to subtract the Assets and Liabilities.

Benefits of making a Balance Sheet in Excel

There is no doubt that Excel is a tool that can greatly facilitate everything related to the accounting and financial exercise.

In this way, creating a balance sheet does not escape the benefits of Excel, so you will obtain multiple benefits.

Allows you to keep the company's finances in order

As we mentioned previously, a balance sheet in Excel provides the necessary information to quickly know the financial and economic status of the company. The Microsoft tool also offers the possibility of updating this data in the fastest way. This way, you can always have the company's finances organized, updated and available.

Identify the profitability and efficiency of the company

Through information on Liabilities, Assets and Net Worth, it is possible to identify how much a company costs. From the Net Worth, for example, we can have a vision of the profits generated and the money that is part of the business. Meanwhile, with the information on Assets and Liabilities, it is possible to know the assets you have and the level of debts.

By displaying all these sections in a general balance sheet and with the necessary knowledge, it is possible to identify how a company is doing.

Determine working capital needs

When we talk about working capital, we refer to everything the company needs to maintain its operations in the short term. That is, from working capital come payments to employees, services and everything required for its operation during the month.

Thus, from an updated balance sheet we can determine the needs of this section in order to prevent a deficit that affects business continuity.

Related questions

Checking the figures shown in your balance sheet is crucial to define that we are dealing with a reliable document. In that sense, you can verify the totals starting from the following formula:

Total Assets = Total Liabilities + Equity.

To know if the rest is correct, just clear the formula and start doing the calculations. If you want to learn more about this, you will find everything you need in our Basic Excel Course.

The balance sheet can have various variations that lead us to a precise vision of certain aspects of the business. In that sense, companies can generate these 3 types of balance sheets:

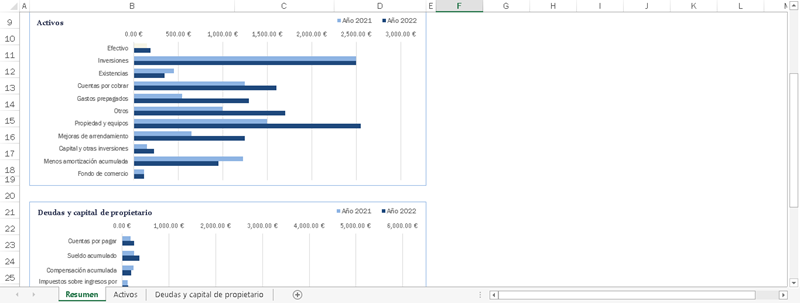

• Comparative: with this type of balance it is possible to know the development of an element (liabilities, assets or equity) over time.

• Consolidated situation: It is used in those companies that have subsidiaries, since it allows you to observe the panorama of all the businesses in one place.

• Proforma: It is a general balance sheet with a view to the future and serves to project a feasible financial and economic situation, which can later be compared with the real evolution.