How to make a salary calculation in Excel?

The salaries paid in any company must first be calculated in detail and reflected in the salary settlement document. In that sense, we want to talk about how to make a salary settlement in Excel in Chile, considering that each country has its particularities in this aspect.

What is a salary settlement?

When a company prepares to pay the salaries of its workers, it first makes a series of calculations taking various factors into account. The salary settlement is the document where all these calculations are reflected and which has a support function for both the employee and the company.

Benefit of calculating labor settlement in Excel

Using Excel will always be a plus in your business processes, especially those related to payment. It will allow you to reduce or eliminate errors when making calculations and you will also be able to automate constants related to labor legislation. That is, you can create predefined formats for salary settlements in Excel and it is something that you can delve into from our training courses. Excel for Business.

What elements should a settlement calculation in Excel contain?

If you need to make salary settlements in Excel in Chile, then you must take into account a series of necessary elements for the calculation to be correct. These elements are contemplated in labor legislation and should only change if the law does so.

Business and people data

Firstly, the business data corresponds to the company name, RUT, address and in some cases we can find contact numbers. For its part, personal data refers to everything that identifies the worker: full name, RUN, position and similar data.

The specific data of the employment relationship

The specific data of the employment relationship involves details about the type of contract the worker is under, the working hours that must be completed and its start date.

Salary, extra pay and days

What refers to salary, extra payments and days worked represent the core area of salary settlement. In this section, the worker's working days must be specified and, based on this, the salary they will receive and also the bonuses, if applicable, must be detailed.

The salary to be received

After all the calculations made through the different factors involved in salary settlement, we are left with a total that represents the salary to be received. The great advantage of using Excel for all this is that the final result can be obtained automatically, through the entry of the data that we mentioned before.

How to calculate my settlement in Excel?

To calculate your settlement in Excel you can have on hand a settlement format created by yourself. It is a simple process where you must take into account a series of factors that are part of the formula to reach the result we are looking for: the net salary.

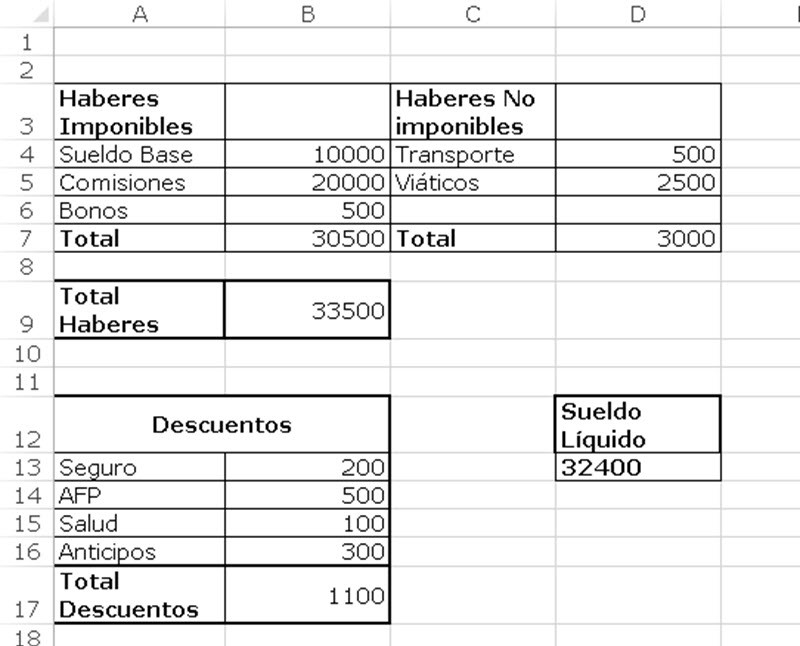

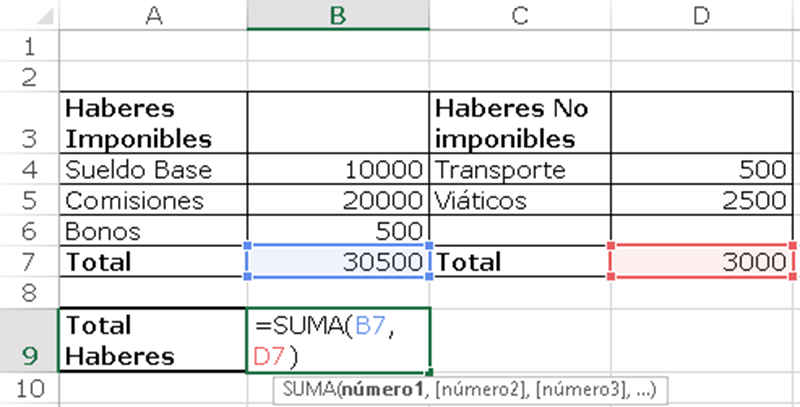

Add Taxable and Non-Taxable Assets

The first calculation to be made will be the sum of the Taxable and Non-Taxable Assets.

The former refer to the worker's fixed income, such as commissions, bonuses and base salary. For its part, Non-Taxable Assets are those incurred by the employee to perform their tasks. Here we can mention travel expenses, compensation, transportation and more.

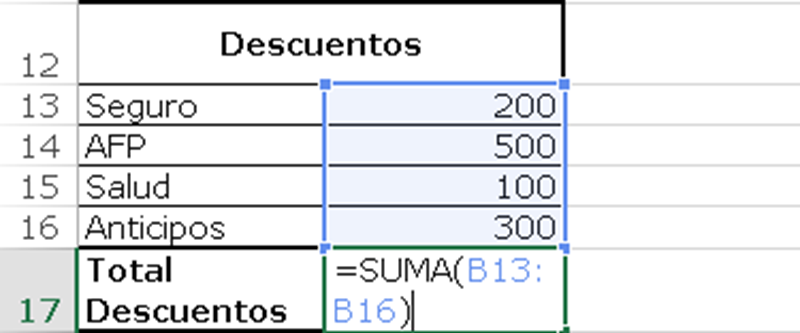

Deduct legal taxes

The next step will be to deduct the legal taxes from the previous result. These are the deductions for AFP, health policy, taxes, among others.

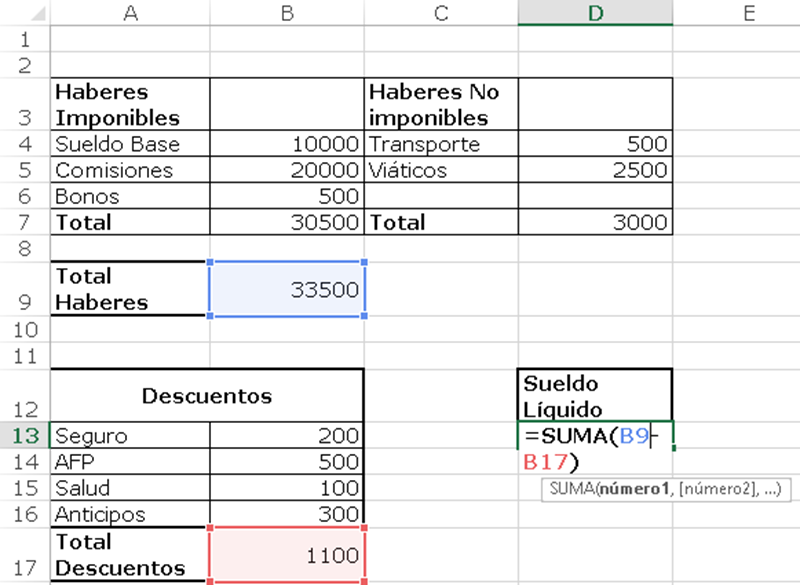

Calculate net salary

The net salary is the total amount that the worker will receive after the addition of Taxable and Non-Taxable Assets and the subtraction of legal discounts and other deductions. In that sense, it's all a matter of inserting this formula into your Excel table and obtaining the result quickly.

Related questions

This process is very simple, although you must have all the necessary data. The basic salary is the amount we get before subtracting legal taxes and other deductions. In that sense, you will need to know your base salary, overtime, holidays worked, bonuses, tips and everything that represents an income.

By adding all these elements, you will obtain your basic salary. To do this, it is just a matter of adding each amount in a cell and using the SUM function to obtain the result.

Considering that the labor settlement is a document that reflects everything received and deducted from a worker's salary, in Excel we can find 3 different alternatives.

First of all, we have the salary settlement that we discuss in this article. Additionally, we can also create social benefit settlements and settlement settlements for termination of the employment relationship.