How to use Excel to control personal finances?

Keeping our personal finances in order is something we can easily do from Excel. If you are looking for a way to monitor your expenses and income without having to install additional applications, Microsoft's tool is there for you to do it.

How to use Excel to manage money?

Excel is a program whose strength lies in performing calculations. Considering that, for money management, we use budgets or expense sheets, the answer to how to organize my personal finances is found in Excel.

In this way, it will be enough to define the format under which you want to manage your finances and apply the addition and subtraction formulas that are necessary to obtain the results.

What is a personal budget Excel template?

Previously, we have talked about Excel templates and in that sense, you should know that there are many aimed at creating personal budgets. An Excel template for a personal budget is nothing more than a pre-designed document with everything you need to start managing your finances. This means that you will have a file ready with all the formulas, headers and layout necessary to work easily.

In addition, it should be noted that the templates are completely customizable, so you can make the adjustments you want.

How to make an Excel to keep personal finances?

Considering that Excel is an excellent tool for managing personal finances, you must take into account a series of items before starting to use it.

Define financial objectives

If you are looking to manage your personal finances from Excel, you surely have a reason for this. Maybe you are spending more than you should or you probably have a trip or renovation in mind that warrants a savings regime. The first step will always be to define your objectives, so that they can be real and measurable.

Categorize expenses

Once your objectives are defined, you must categorize the expenses you generate. For this we have 3 categories: fixed, variable and discretionary expenses. Fixed expenses are those that remain constant on a monthly basis, such as rent, mortgage, condominium, internet service payments, among others.

For their part, variable expenses are those whose prices can fluctuate when they occur. This involves maintenance services, water, electricity, food and more.

Meanwhile, discretionary expenses are those that we make with some frequency and whose amounts can vary. They involve going out to dinner, to the movies or purchasing items that are not strictly necessary.

Load income into Excel

Once you've identified and categorized your cats, you're then ready to load all your income data into Excel. It is from this amount that the discounts on the expenses you make will begin to be made.

Update expenses in Excel

Finally, we have to enter the data regarding our expenses in Excel. In that sense, you will have to start inserting your 3 types of expenses and verify how they are reflected in your personal finances.

Benefits of using Excel to control personal income and expenses

Personal finances are a matter of organization and Excel is a tool that makes it much easier. Having a sheet to control income and expenses is a great way to keep an eye on our monthly budget, in addition to benefits such as the following.

Constant updating of expenses

The way to maintain the functioning and usefulness of an Excel sheet to control personal income and expenses is to constantly update it. To do this, it is best to save your invoices and enter the amounts in the Excel table at the end of the day. This will always keep you updated with your expenses.

Details of personal expenses

Many times we don't know what happened to that money we got at some point. An Excel sheet can solve this issue, because it has details of our personal expenses. Plus, since we always have them updated, we can get answers quickly.

Project investments

Knowing how your personal finances are doing will give you a platform so you can plan future investments. If a business opportunity appears, you will be able to quickly know if you can get involved or not, with the projections obtained from your personal budget.

Control savings capacity

Do you need to save a little more? Review your Excel budget and see if you are having too many discretionary expenses. Probably, there are increases that you have not noticed in your variable expenses, all the elements are there, ready for you to analyze and control your saving capacity.

Related questions

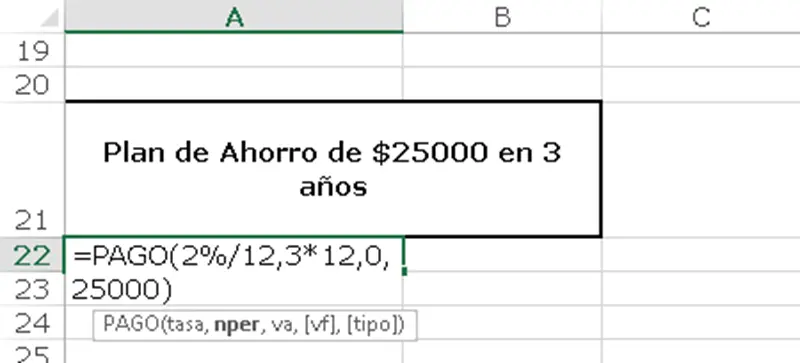

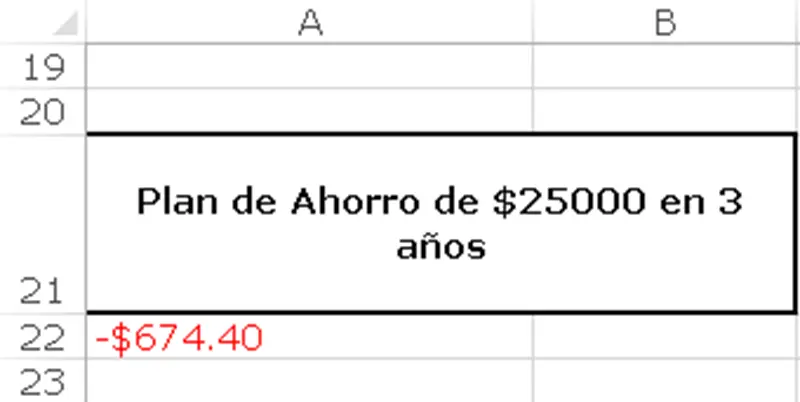

If you have the goal of reaching a certain amount of money in your savings account, for a trip or any project you have in mind, you can use the PAYMENT function. It is one of the simple functions that you can learn in our Basic Excel Course.

The syntax would be the following: =PAYMENT(Annual Rate, Amount of monthly payments*Year, Present Value, Future Value)

Where:

• Rate: annual interest rate from your bank. It is divided between the 12 months of the year.

• Amount of monthly payments*Year: refers to the number of payments you will make in the amount of time you will be saving. In this case we multiply 3 years by 12 months.

• Current value: amount with which you start your savings plan. It can be 0.

• Future Value: amount you want to reach. In our example they would be $25000.

The total amount you should save monthly would be $674.40

Microsoft has a website available with all the templates they officially have. In its Budgets section you will find a whole series of alternatives for personal finances, ranging from the most basic to the most complex.

You can download free personal finance templates that can be as detailed or simple as you need.

Vito Hernandez

Graduate in Social Communication and Journalist. Mainly creative before everything. Now writing about Excel and Human Resources for the common man.