Support your workers with Sence courses

Train with Sence? Yeah! The technical body of the Ministry of Labor has a series of benefits that will help you finance your 2023 training program. We invite you to learn about it in this blog.

In the blink of an eye, 2023 arrived and it is time to take stock, projections, set objectives and more, but along with this, also the challenge of training your teams. This involves analyzing subjects, courses, providers and more.

In Ninja Excel, we understand that all of this can be overwhelming. For this reason, we bring you the definitive Sence guide to help you in an area that you should consider within this programming: 2023 training in your organization.

What is Sense?

The National Training and Employment Service or Sence. It is the technical organization of Chile in charge of energizing, supporting and developing human capital in companies.. This, through different strategies such as employment subsidies, the search for job offers through the OMIL (Municipal Labor Information Offices), training programs, and the tax exemption for training. Let's review the detail and its operation below:

How does SENCE work in Chile?

As we told you, Sence has different initiatives focused on finding, supporting and maintaining employment. One of these, and the one that will help us carry out training for your company, is the tax exemption. Before reviewing the latter, we will tell you a little about the different tools that SENCE has available:

1) Employment subsidies

The office of National Training and Employment Service, also seeks to encourage the job search monetarily through subsidies, such as the Youth Employment Subsidy or the Women's Work Bonus.

2) Job search through OMIL offices

The Municipal Labor Information Offices They help neighbors find work within their respective communities and thus strengthen local labor forces and reduce unemployment.

3) Training programs

SENCE On its website it has different free courses focused on increasing employability through specializations. You can find options for different areas and different levels of schooling.

4) Training Tax Franchise

The tax exemption consists of grant companies that contribute in the first category a 1% discount on income tax, which they pay annually, for expenses incurred in training authorized by SENCE.

How does it work? Once you have checked that the training to be carried out is authorized by SENCE, you must meet two other aspects to access the benefit of the tax exemption. In the following title we tell you more details:

What is the Sence tax exemption?

The tax exemption It is a Sence benefit granted by the Ministry of Labor to companies that pay taxes in 1st category. This allows you to help finance the training of your organization's collaborators to improve their productivity. The franchise can be used for the specialization, evaluation and certification of skills of workers and people not linked to the company, through tax reductions. Does it sound too good to be true? We tell you more about her:

How does the tax exemption work?

In order to access the different benefits offered by the Sence tax franchise, you must consider the following requirements:

-

- Pay taxes in the 1st category of the Income Law.

-

- Have an annual payroll of taxable remuneration greater than 35 UTM.

-

- Have your collaborators' pension contributions paid.

If you have them, you can access different training activities. Something very relevant if we remember that, according to lifehack, there are a series of strategies to increase productivity, such as “investing in training and development” to guarantee the effective achievement of goals and objectives.

The best is that You can use this benefit for different types of contracts:

-

- Hired: For workers who maintain a link of subordination and dependency with the company that uses the tax exemption.

-

- Pre Contract: Useful modality for training people who do not maintain a link of subordination and dependency with the company that uses the Sence benefit.

-

- Post Contract: Ideal for former employees of companies that have a tax exemption. It is important to consider that it must be carried out no later than five months after the date of termination of the employment relationship.

Now, you know who you can train and what requirements you must meet to access the Sence tax franchise. But now let's see how it can help you finance your company's 2023 training plan.

Sence's tax reduction

You can use the tax benefit of the Sence tax franchise in different instances as we already mentioned. One of them is the training of your collaborators in order to develop and boost productivity in your company.

This tax reduction consists of granting organizations that meet the requirements that we mentioned, the possibility of deducting income tax up to 1% from the payroll, to invest in training registered with Sence. That is, the amount used in this investment will be reflected as a reduction in your organization's income tax.

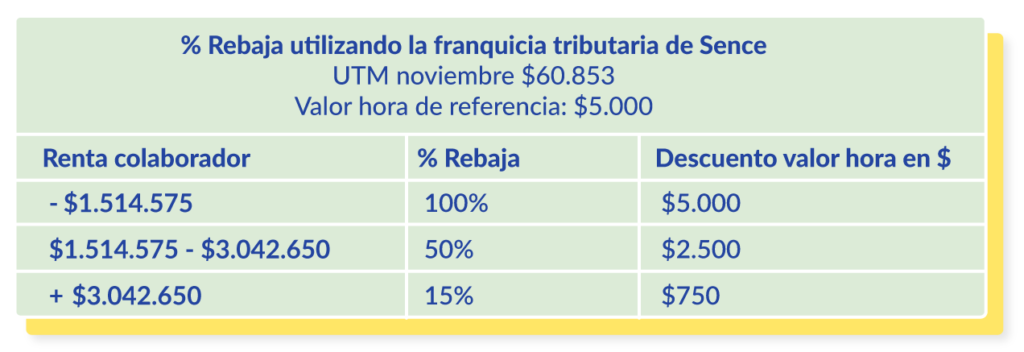

Now, this will depend on the remuneration of each employee you are going to train. To get an idea, check the following table and the value of the UTM when reading this blog. To exemplify, we will use the UTM value for November and an hourly value of $5,000:

It is important that you remember that although the remuneration sheets are annual, you will see this reduction in April through the tax refund from the Internal Revenue Service (SII).

So what are you waiting for to plan a great 2023 training program? With this information you can now start this process that is so relevant for your company. As a final tip, always keep in mind that since Harvard Business Review, state that productivity is a combination of skills and tools for organizations and individuals:

“Those tools will not make workers more productive unless they are also taught a solid methodology for using those tools.”

Harvard Business Review

The essential Sence guide you need

At Ninja Excel we know that all this may sound complex. For this reason, we have prepared a quick guide for you with all the steps you need to know to be able to use the Sence tax benefit in your organization. To download it, you just have to leave your information in the following form:

Vito Hernandez

Graduate in Social Communication and Journalist. Mainly creative before everything. Now writing about Excel and Human Resources for the common man.