Settlement calculation: How is it done in Chile?

Have you ever gotten complicated when calculating your settlement? This is a very important document in the termination of any employment relationship since it is a worker's right. Today we want to help you and make this process easier in which the paths of the employer and the collaborator separate. Read on to learn all about this important document.

What is a settlement?

The settlement in Chile It is the legal process by which the term of the employment relationship between a collaborator and his or her company is explicit.. For this, a document is made that determines the causes and conditions of the worker's departure and, in addition, stipulates the amount of money that is given to you when you leave the organization. This process is only exempt for those companies that have collaborators who have an employment contract of less than 30 days.

This action must be done before a minister of faith to ratify the cause for the termination of the contract and specify different aspects. We tell you more below.

Salary owed

The collaborator must be paid for the days worked since the last payment. It is important that all possible variants such as commissions, bonuses, etc. are considered. Remember that these may be taxable, so you must take this into account for the calculation.

Compensation for prior notice

The employer is obliged by the Labor Code to notify the worker at least 30 days in advance of his dismissal. If this is not met, you must compensate the collaborator with the amount equivalent to one month's salary. This payment can only be omitted if the worker has breached his contract.

Compensation for years of service

To obtain this amount, the sum paid for the last 30 days of work must be considered (this has a limit of 90 UF) and based on this, calculate one month of salary per year of service or fraction greater than 6 months (it has a limit 11 years of work).

Pending vacations

Each worker in Chile is entitled to 15 working days of paid rest, once they have completed one year in the organization. Once this time has elapsed, if the employee resigns and the employee has not taken these days off, they must be paid.

Proportional vacation

If the worker has not taken his vacation, he must receive the proportional payment of the vacation he accumulated. To obtain this calculation, you must divide the number of vacation days that a worker gets per year worked by 12. With this you will obtain the number of days to be paid per month. Once you have it, you must multiply it by the number of months that have passed since their last vacation, or since the worker's entry, until the end of their contract (in case their vacation does not yet correspond to them).

Remember that for the settlement to be valid, it must be ratified through the Labor Directorate website or at a notary office, and have the signature of the employer and the collaborator.

How to calculate a settlement?

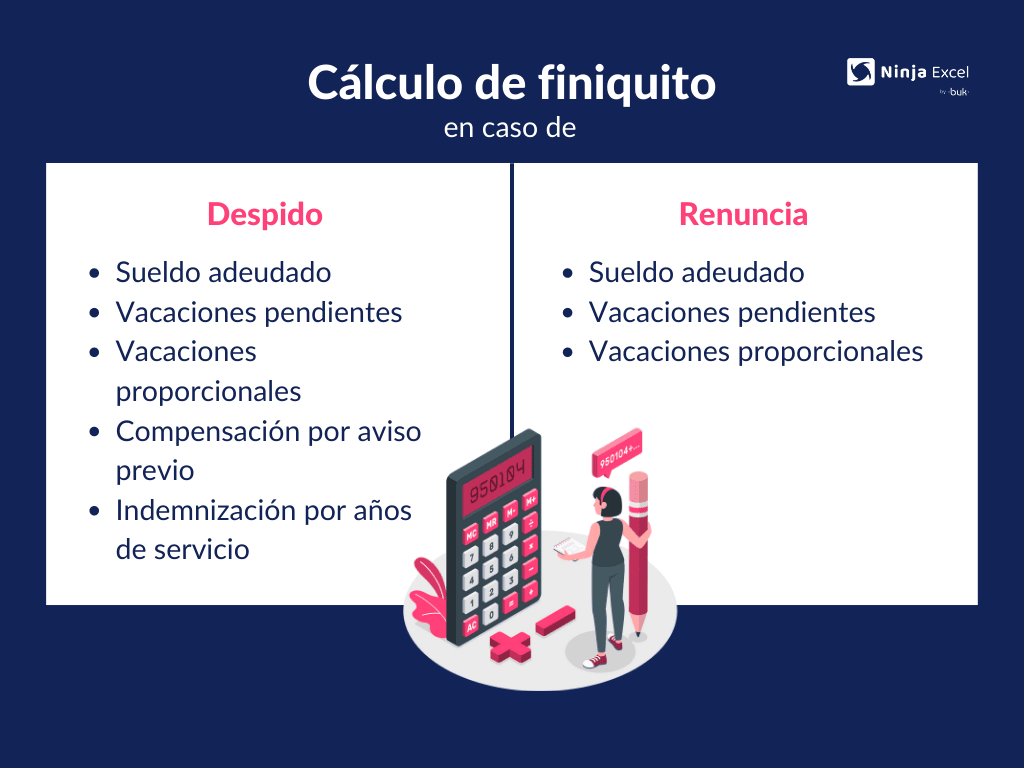

The calculation of this sum of money may vary depending on the type of contract, and the reasons for the worker's departure. For this, there are three cases:

- Resignation: the worker decides to leave the company on his own.

- Contract term: here there is a stipulated date on which the collaborator's functions cease.

- Dismissal: The worker leaves the organization by decision of the company.

Settlement calculation: example

Now, it is time to put theory into practice. For this we will give the following examples:

- Daniela resigned from her company: Daniela earned $630,000 and spent 2 years, 2 months in the company. She took 30 days of vacation and it has been 10 days since the last payment.

- Carlos was fired from his company: there Carlos earned $550,000. He worked for 2 years and 6 months in the company. During that time, he took 30 days of vacation. They communicated this decision to you without 30 days notice and 17 days have passed since the last payment.

As we explained, there are different calculations for these two cases. We will review with these examples the logic that must be followed for both situations.

Calculation of severance pay for resignation

To know what settlement Daniela is entitled to receive, we will consider the salary owed, the pending vacations and the pending proportional vacations.

| Carlos' settlement due to dismissal | ||

| Salary owed | 17 days | 550.000/30*17= $311.666 |

| Pending vacations | 0 days | $0 |

| Proportional vacation | 15/12*6= 7.5 days | 550.000/30*7.5= $137.500 |

| Compensation for prior notice | Compensation is due | $550.000 |

| Compensation for years of service | Corresponds to 2 years | 550.000*2= $1.100.000 |

Adding up all the previous breakdown, Carlos should receive the sum of $2,099,166 in his settlement.

Calculation of severance pay for dismissal

In the case of Carlos, the calculation of his settlement works differently. For this, we must consider the following table:

| Daniela's settlement due to resignation | ||

| Salary owed | 10 days | 630.000/30*10= $210.000 |

| Pending vacations | 0 days | $0 |

| Proportional vacation | 15/12*2= 2.5 days | 630.000/30*2.5= $52.500 |

Considering the above, Daniela should receive the sum of $262,500.

With this information in mind, you will be able to calculate settlements without problems. Remember that, although we tell you how to calculate the amount to be compensated, it is also important that you make sure that the reason for the end of the employment relationship is well specified.

We hope we have helped you! Now you will no longer have headaches when calculating the severance pay of collaborators. At Ninja Excel we want you to learn with us. You can read more related information, such as what you should know about net and gross salary if you work in Chile here.